“Mastering Your Money: A Guide to Strategic Financial Management for Maximum Wealth Growth”

Introduction:

In the dynamic landscape of personal finance, the ability to master your money through strategic financial management is the key to achieving long-term wealth and financial security. In this comprehensive guide, we will delve into the fundamental principles and advanced strategies that empower individuals to take control of their finances, make informed decisions, and pave the way for substantial financial growth.

1: Understanding the Basics of Financial Management

Financial Management Defined:

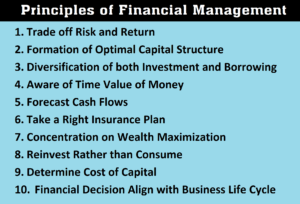

Financial management involves the planning, organizing, directing, and controlling of financial activities within an organization or, in this case, on a personal level. It’s a holistic approach to money that goes beyond budgeting and savings, encompassing investment, debt management, and overall wealth optimization.

Setting Financial Goals:

The first step in strategic financial management is setting clear, achievable financial goals. Whether it’s buying a home, funding education, or retiring comfortably, well-defined goals provide the roadmap for your financial journey.

Budgeting as the Foundation:

A solid budget is the cornerstone of effective financial management. We’ll explore not only how to create a realistic budget but also how to stick to it, ensuring that your spending aligns with your financial objectives.

2: Building Wealth Through Smart Saving and Investing

The Power of Compound Interest:

Understanding compound interest is crucial for wealth accumulation. We’ll explore how compounding works and why starting to save and invest early can significantly impact your financial future.

Diversification and Risk Management:

Effective investing involves more than just putting money into stocks. Discover the importance of diversifying your investment portfolio to manage risk and maximize returns.

Strategic Investment Vehicles:

Explore high-yield investment options, such as mutual funds, exchange-traded funds (ETFs), and real estate. We’ll discuss potential returns, risks, and how to choose investments aligned with your risk tolerance and financial goals.

3: Debt Management Strategies for Financial Freedom

Tackling Debt Head-On:

Not all debt is created equal. Learn how to differentiate between “good” and “bad” debt and employ strategies to pay down high-interest debt efficiently.

Consolidation and Refinancing:

Explore options like debt consolidation and refinancing to streamline payments and potentially reduce interest rates, helping you take control of your debt more effectively.

Negotiating with Creditors:

Proactive communication with creditors can open avenues for negotiation. We’ll discuss how negotiating interest rates or settlement amounts can make a significant impact on debt repayment.

4: Advanced Financial Strategies for Long-Term Success

Tax Planning and Optimization:

Discover the art of tax planning to minimize liabilities and maximize savings. Explore tax-advantaged accounts and strategies to optimize your financial position.

Estate Planning for Generational Wealth:

We’ll delve into the importance of estate planning, discussing wills, trusts, and other tools to ensure your wealth is preserved and passed on efficiently to future generations.

Continuous Learning and Adaptation:

Financial markets evolve, and so should your financial strategies. Learn the importance of staying informed, adapting to economic changes, and continuously improving your financial management skills.

Conclusion: Empowering Your Financial Future

In conclusion, mastering your money through strategic financial management is a lifelong journey. By understanding the basics, making informed investment decisions, managing debt wisely, and incorporating advanced financial strategies, you can achieve financial freedom and build lasting wealth. Embrace the principles outlined in this guide, stay committed to your financial goals, and embark on a path to financial success and security.